The Basic Materials Industry includes Chemicals, Metals, Mining, Forestry and Paper. Output prices for these sectors have been very volatile in the past 12 months, reflecting recent rapid structural changes in the global economy.

Metals for steel and alloy production – Aluminium, Iron Ore, Lead, Zinc, Manganese, Molybdenum and Tellurium are mainly down. Rare earths used in mobile phones, EVs, batteries, catalytic convertors, and flat screens – such as Rhodium, Titanium, Lithium, Palladium, Neodynium – are higher, with Lithium up over 200% YoY. Mined fuels such as Coal are up nearly 150% over the past 12 months in response to the Ukraine war. Urea ammonia for fertilizer is up more than 100%. Precious metals are modestly down, despite surging global inflation. Some key chemical outputs with wide consumer and industry applications – Polyethylene, Polypropylene and Polyvinyl – are also weaker although PVC prices have spiked more recently. Semiconductor inputs are mixed – Germanium (a largely China-controlled market) is down over 15%, but Gallium is up nearly 50%.

This environment is very positive for some Basic Materials firms but – overall – the sector faces increasing uncertainty as interest rates hit economic growth. US Basic Materials companies recorded a run of 15 months of net improvements from Nov-20 to early-2022. However, this year has been more erratic, with multiple months of net improvement and net deterioration.

Figure 1 shows the Credit Consensus Indicators1 (CCIs) for US Basic Materials.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. To arrange a demo of all single name and aggregate data detailed in this report, please request this by sending us an email.

Figure 1: Credit Consensus Indicators (CCIs), US Basic Materials: Feb-16 to Aug-22

More CCI industry graphs can be found within Credit Benchmark’s monthly CCI Monitors.

This sample of more than 350 US Basic Materials companies have recorded a few CCIs below 50 recently. However, in the latest month, US Basic Materials CCI is above 50, indicating that upgrades now outnumber downgrades.

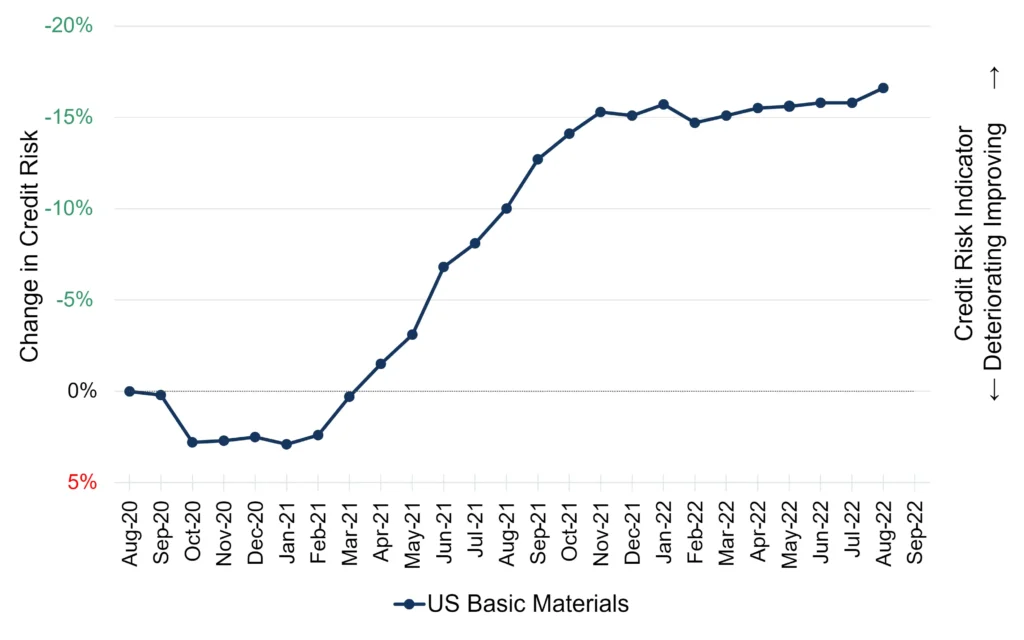

Figure 2 shows the credit trend for US Basic Materials.

Figure 2: Credit Trend, US Basic Materials; Aug-20 to Aug-22

US Basic Materials average credit risk – measured by default probability (axis inverted) – has shown some improvement this month. The CCI indicator may be picking up on early-stage changes in credit opinions that will feed into an even lower average PD in coming months.

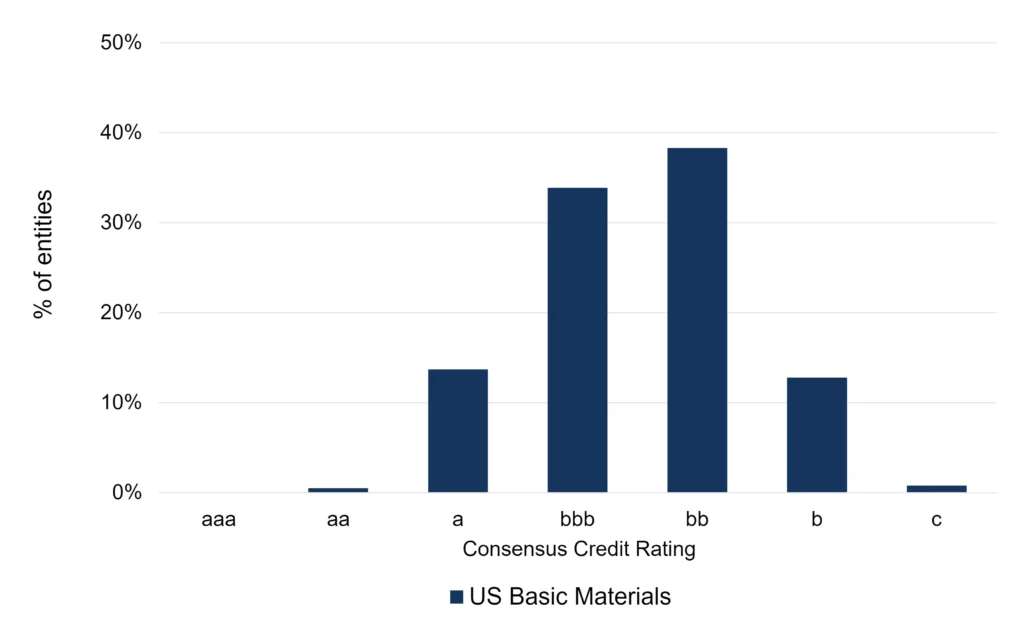

Figure 3 shows the current credit distribution for US Basic Materials; less than 50% are rated investment grade.

Figure 3: Credit Distribution, US Basic Materials; Aug-22

[1] The CCI is an index of forward-looking credit opinions based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to start a trial or to request a coverage check: